Securing an H-1B visa is a stepping stone in accessing global talent, but there are certain compliance requirements an H-1B employer must follow to remain aligned with USCIS guidelines. Failing to meet these obligatory regulations can result in serious consequences such as fines, audits, and reputational damage.

Is your HR team fully aware of these compliance requirements? If not, now is the time to act, as even a minor error can lead to hefty penalties.

This article discusses the consequences of H-1B benching and steps employers can take to avoid common pitfalls while managing their H-1B responsibilities.

What is H-1B Benching?

H-1B benching refers to situations when the H-1B employee is in a non-productive phase and is not actively working on any project.

This can happen due to:

- Lack of project assignments

- Delays in the project availability

- Pending licensing/permitting processes

- Employer-requested nonproductive time (attending orientation or training sessions)

Why is H-1B Benching Illegal?

Employers hiring H-1B workers are legally obliged to fairly compensate their employees and ensure they have sufficient work throughout the H-1B period.

According to USCIS and the Department of Labor guidelines, H-1B benching is an illegal offense because:

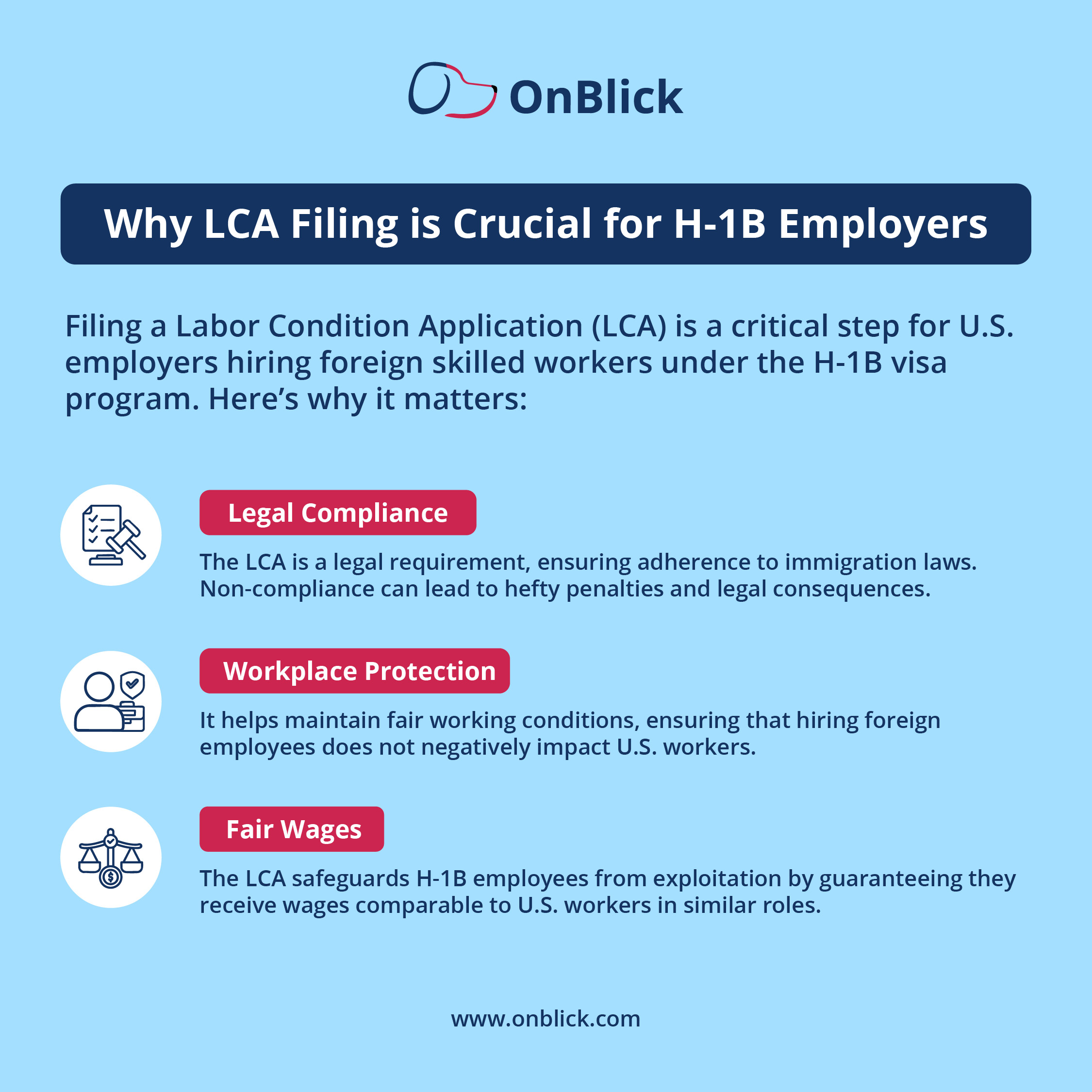

- Violation of LCA: Sometimes when employers bench their employees, they refuse to compensate them fairly, which is a direct violation of the Labor Condition Application.

- Wage theft: According to DOL guidelines, the employer must fairly pay the H-1B worker, even during non-productive time, unless the employee is unavailable due to non-work-related reasons.

- Immigration fraud risk: When an employer hires an H-1B worker on a full-time basis but fails to provide them with work, it is considered a form of immigration fraud.

- Disruption of the worker’s legal status: H-1B benching can jeopardize the legal status of an H-1B worker, potentially leading to the termination of their legal stay in the U.S.

- Unfair competitive advantage: H-1B benching gives employers who bench their employees an unfair advantage over those employers who follow all rules and maintain compliance with the USCIS guidelines.

H-1B Benching: Understanding Employer’s Obligations

An employer’s statutory duties are much more than just ensuring their workers are fairly paid; they must follow strict guidelines set by USCIS to protect their rights and comply with immigration policies.

Here are a few key responsibilities every H-1B employer must fulfill:

- The employer needs to pay the employee an actual or higher wage as compared to other employees with similar experience.

- The employer must protect the H-1B employee’s rights and ensure a transparent working environment.

- The employer must ensure no strikes or lockouts involving the H-1B worker’s position at their workplace.

- The employer must provide LCA notices to H-1B employees.

- The employer must maintain the following documents to ensure compliance with immigration laws:

- A filed copy of the LCA.

- Documentation of the salary paid to the H-1B employee.

- An explanation of how the actual wage was determined.

- Documentation of how the prevailing wage was determined.

- Whether an H-1B employee is actively working or is benched, the employer must pay full wages to the H-1B worker for all the non-productive time caused by situations, such as lack of work, lack of a permit, or studying for a licensing exam.

- The H-1B employer must pay full wages:

- When the H-1B worker enters employment and is available to work.

- When the H-1B worker enters the U.S. on an approved petition and is available to begin work.

- When the H-1B worker becomes eligible to work, which is typically on the start date listed on the USCIS Form I-797, employers must start paying them within 60 days, even if the employee has not formally started working.

What are the Consequences of H-1B Benching?

- Back wage liability: Employers must pay full wages to the H-1B worker even if they are not working on any project, which can create unnecessary financial stress and affect their future projects.

- Civil penalties and fines: H-1B benching breaches LCA regulations, triggering serious legal and financial consequences. According to several law firms, employers may face hefty penalties ranging from $1000 to $35,000 per violation, depending on the severity of the case.

Take this case as an example, where an H-1B employer was held liable for over $85,000 after failing to notify USCIS of the worker’s termination and benching them.

- Debarment from immigration programs: If H-1B employers fail to follow the obligatory guidelines, then they may be temporarily or permanently barred from immigration programs, which can damage their business growth.

- Reputational damage: If an H-1B employer fails to provide work to their employees, it could compromise ethical and regulatory standards of the company, negatively impacting their image in the industry.

- Frequent site audits: Engagement in illegal practices such as H-1B benching can trigger more frequent site audits to ensure employers are following the guidelines.

Compensation for Non-Productive Time

Employers often face challenges in determining accurate compensation for non-productive time, as there is not enough clarity around this topic. However, employers can maintain compliance by understanding the wage requirements for different H-1B workers and compensating them accordingly:

1. H-1B workers hired to work full-time must be paid the full required wage listed on the LCA, even during non-productive periods, unless the worker is unavailable due to voluntary reasons (e.g., personal leave).

2. H-1B workers hired to work full-time on an hourly basis, must be paid for 40 hours per week or for the number of hours the employer can demonstrate as full-time for their hourly employees.

3. H-1B workers working part-time must be compensated for at least the number of hours mentioned in the Form I-129/ I-129W petition and the Labor Condition Application.

4. H-1B part-time workers with a range of hours listed on Forms I-129/ I-129W must be fairly compensated for at least the hours they worked.

Note- Employers are required to pay the required wage until the H-1B worker's employment is formally terminated through a proper bona fide termination, which includes written notice, return transportation (if applicable), and notification to USCIS.

Best Practices for H-1B Employers

Sometimes, due to unstable markets and unpredictable economic conditions, employers may not have enough or proper work for the employees, which can lead to H-1B benching. However, with the help of a strategic approach, you can mitigate these risks and effortlessly align with immigration requirements.

Some proactive steps employers can take include:

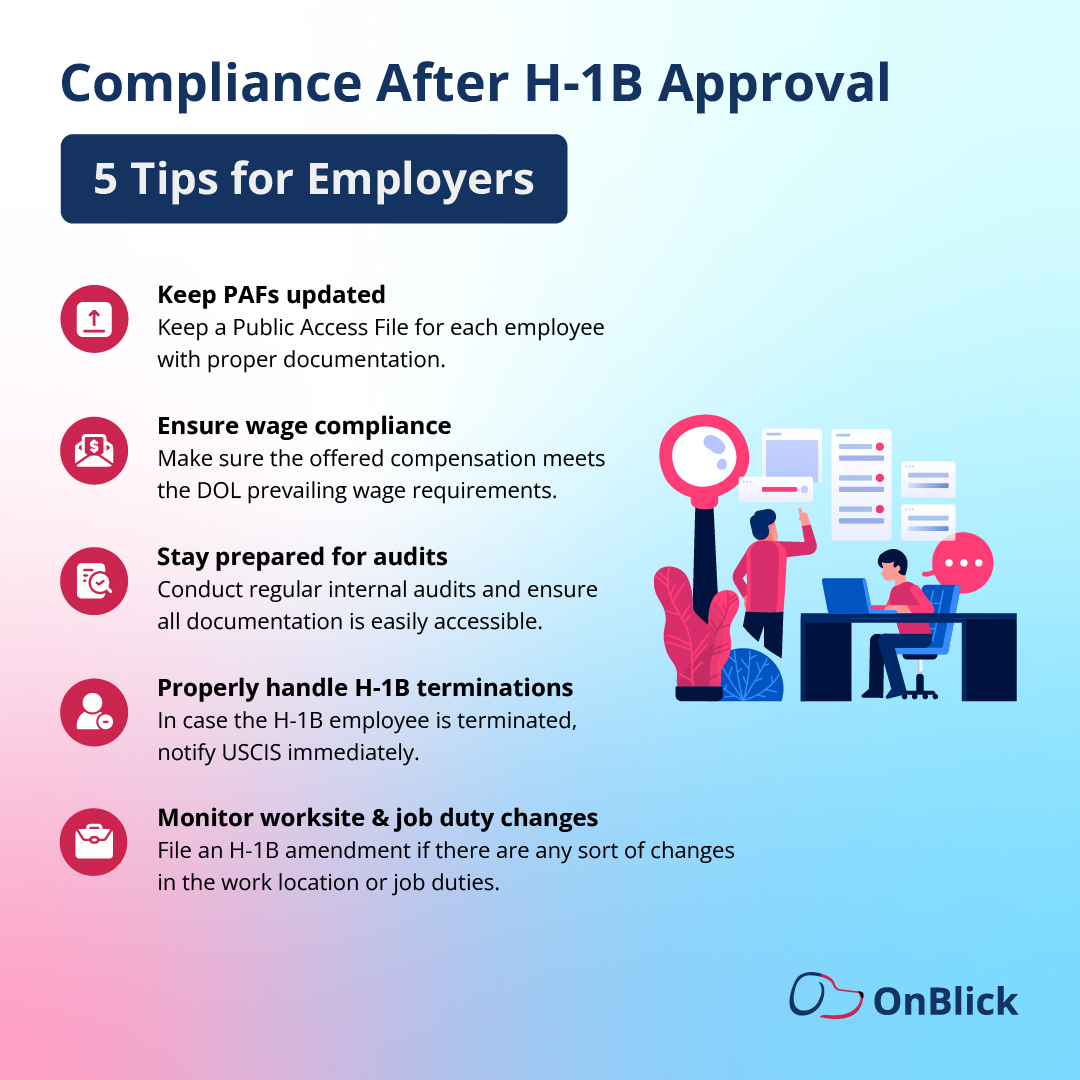

- Understand responsibilities: Before hiring H-1B workers, ensure you understand the regulatory requirements that you must follow to maintain lawful H-1B employment.

- Implement a structured onboarding plan: Being prepared is the key to avoiding risks, which is why you must create a systematic internal plan to manage onboarding, projects, and the bench period (if it ever comes to that).

- Maintain proper records: Save all necessary employment information such as detailed job descriptions, LCA filing proof, work assignments, and timesheets to demonstrate active employment.

- Provide internal tasks: When there is some shortage of work or delays in the project, assign small internal assignments or provide training sessions to H-1B employees that will keep them occupied.

- Consult an immigration attorney: No person can guide you better than your legal counsel; that is why employers must always keep them updated and act according to their advice to make informed decisions.

Summing up

H-1B benching refers to situations when there is insufficient work for H-1B workers due to project shortages or internal delays. It’s a serious compliance risk, and employers may face severe financial and legal consequences if they fail to adhere to these mandatory immigration requirements.

To avoid H-1B benching, employers must have a structured plan from the beginning. From day 1, employers must create an internal system for onboarding, document all essential information, provide training sessions or minor tasks if there is no work for the employees, and consult their legal counsel.

Managing compliance with USCIS standards can get complex, but OnBlick helps you stay ahead with tools designed for accuracy and efficiency. Our advanced tracking system allows you to monitor and manage H-1B obligations with ease, so you can focus on your core business operations.

Book your complimentary consultation today and learn more about OnBlick’s H-1B case management services!

.jpeg)

.gif)

.png)

.png)